Crypto Analysts Offer Contrasting Bitcoin Forecasts Amid Market Uncertainty

Published on 3/13/2025, 3:55:09 PM

In the fascinating world of digital currency, where vast fortunes can be made or lost in a heartbeat, the pendulum of opinion often swings wildly. One such arena where this schism is apparent is in the ongoing debate about Bitcoin's market trajectory. Two standout voices in this dichotomy are the crypto analysts, Doctor Profit and Astronomer, who encapsulate the diverging views within the cryptocurrency community. While Doctor Profit has leaned towards a potential drastic downturn, Astronomer infers that we have weathered the worst of the storm, citing a striking probability of 87.5%.

Are Bitcoin Bears On The Brink Of Sorrow?

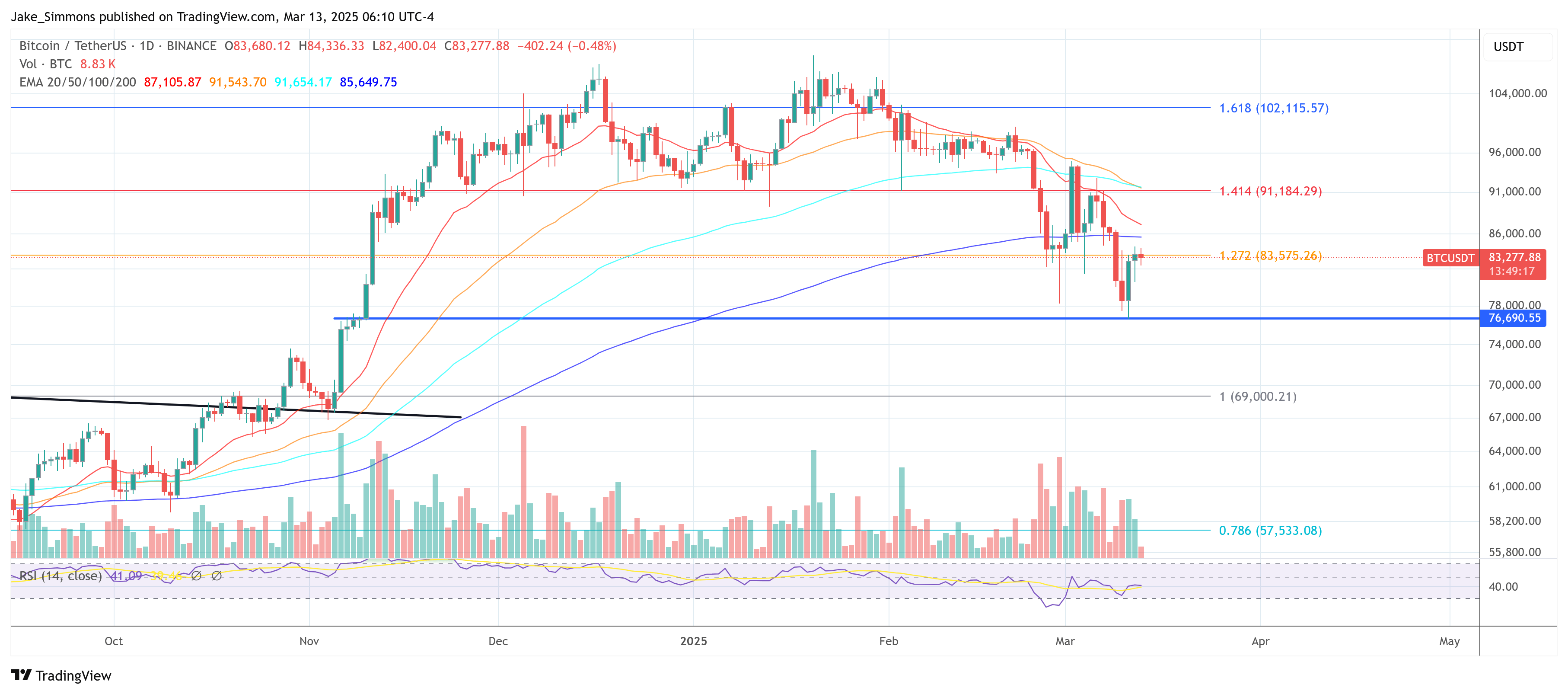

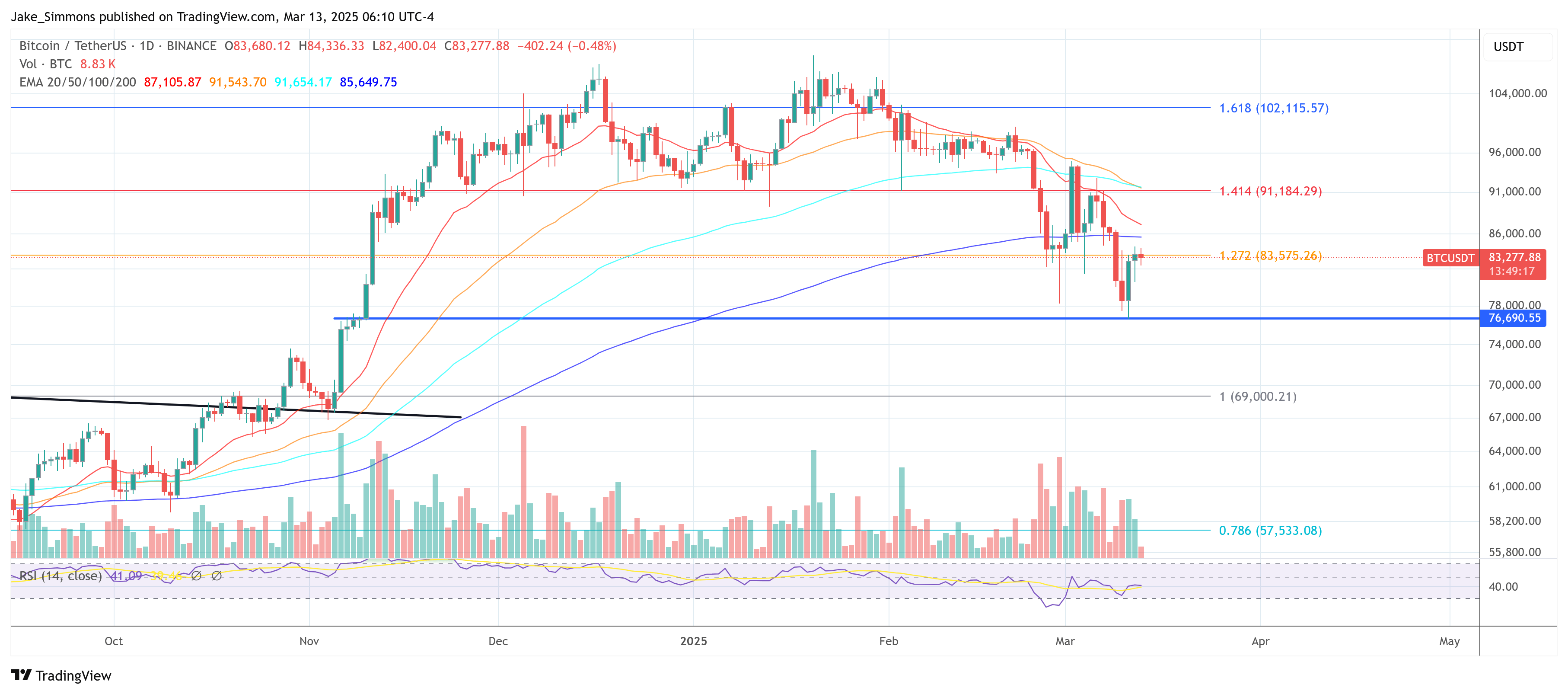

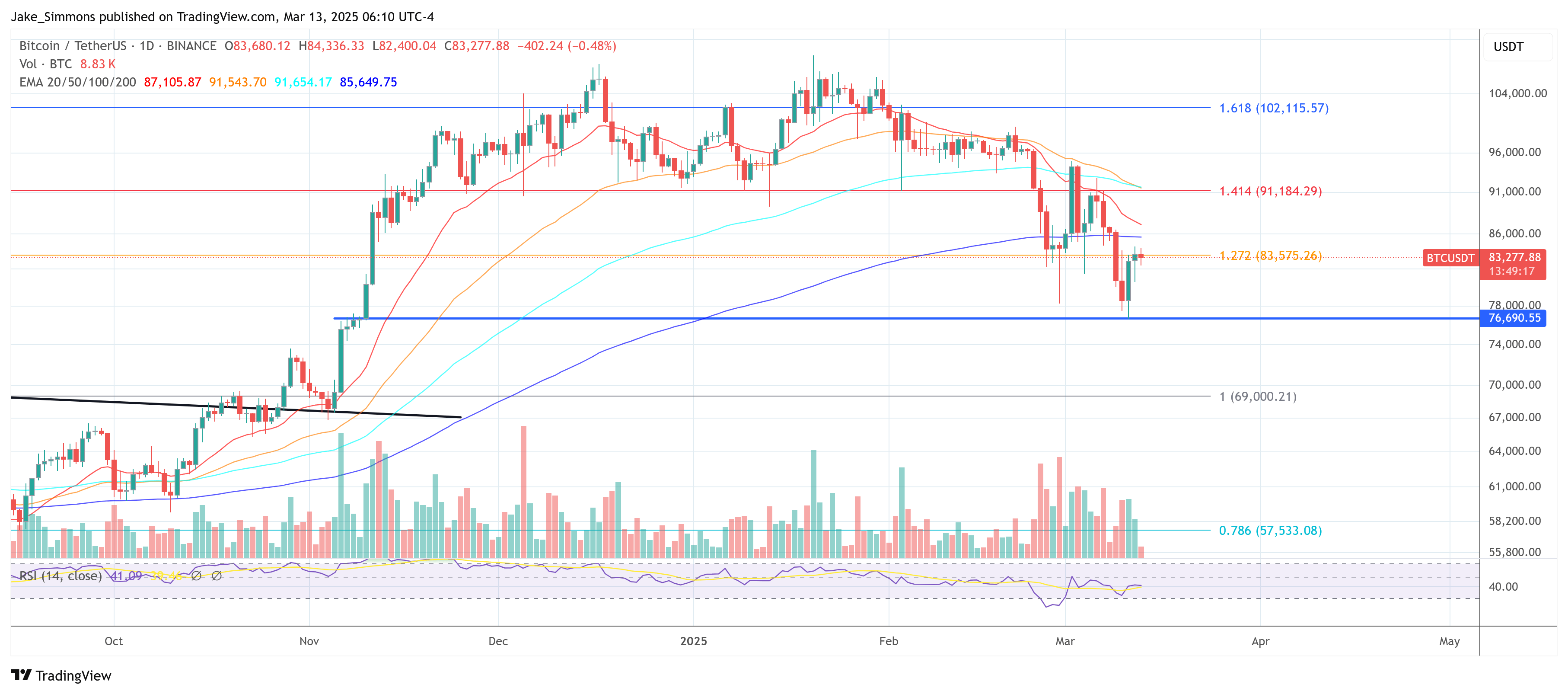

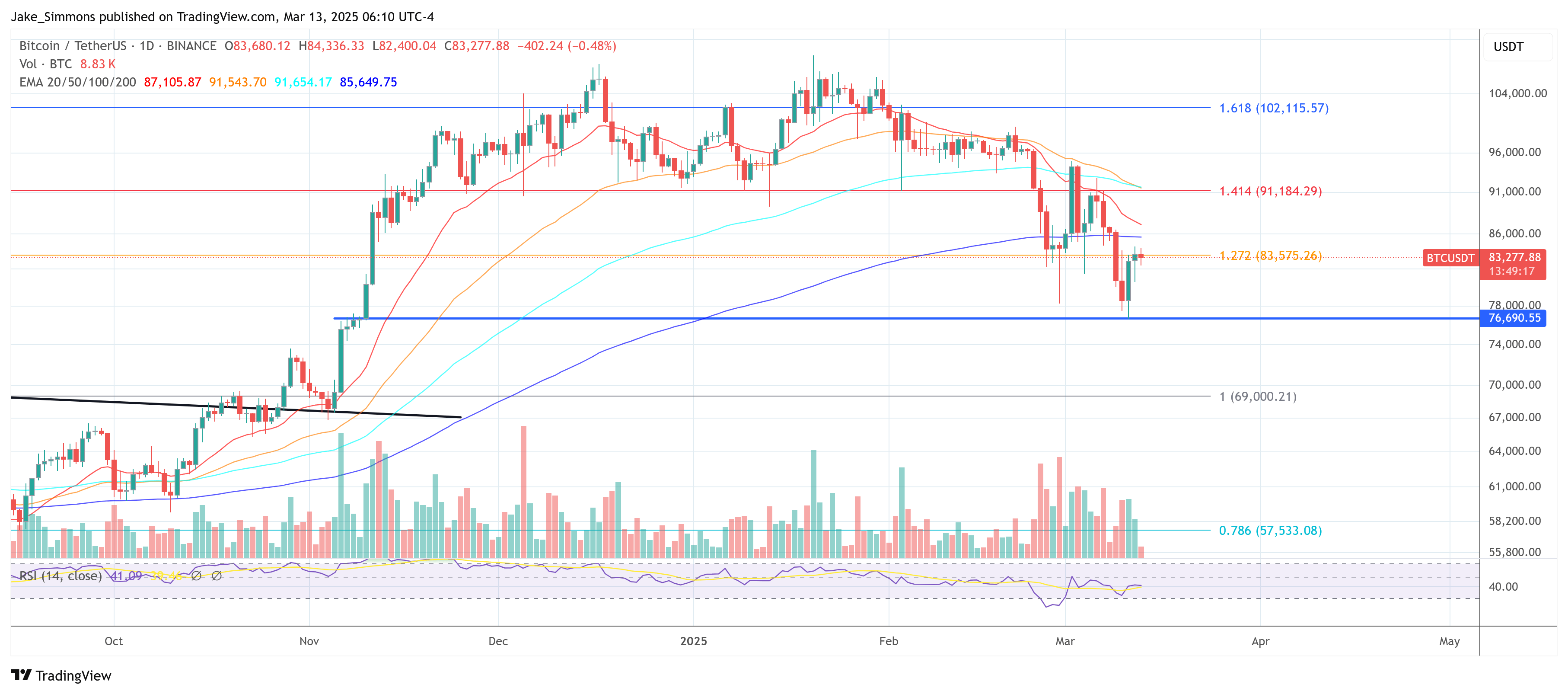

With observations sharp as a scalpel, Doctor Profit (@DrProfitCrypto) shared his insights on X. According to this seasoned crypto analyst, Bitcoin's road map reveals a fork in the road: two scenarios. The first scenario struts an optimistic trajectory pointing towards a 68-74k range in a regular market. The second scenario paints a more ominous image, plummeting towards the 50k zone in a catastrophic full market crash, uneloquently referred to as a "Black Swan event".

A Black Swan event refers to an infrequent and unanticipated event that jolts financial landscapes. Although Doctor Profit shied away from attaching definitive probabilities to these outcomes, he ardently insisted that a Black Swan event was very much in play. His stance has evolved, shaped by recent transformations in the larger financial landscape. Despite its rarity, he now believes a market crash is not beyond the realms of possibility.

In stark contrast to this acute crypto prognosis, Astronomer (@astronomer_zero) gazes upon the Bitcoin universe through a more optimistic telescope. Asserting a bullish stance, he believes that the Bitcoin valley has already been trodden and a climb upwards is the most probable outcome. Astronomer's vision is gleaned from the historical pattern of Bitcoin price fluctuations around Federal Open Market Committee (FOMC) meetings. Intriguingly, his belief in this pattern is so deeply ingrained it amounts to an almost astrological prediction of an 87.5% chance of bottom reversal.

Astronomer's methodology charts Bitcoin price movements in relation to FOMC dates. Significantly, financial markets often anticipate (and price in) decisions on interest rates prior to the official announcements. In fact, the pattern presents itself so consistently that Astronomer contends Bitcoin's low points typically coincide up to five '2D bars' before these meetings.

Per this pattern, the next significant low point should materialize latest by March 19th, the date of the next FOMC meeting. This claim is calculated using the established pattern and historical data, which indicates a turnaround 0 to 5 '2D bars' before every meeting.

To further cement his stance, Astronomer points to a psychological indicator, which he refers to as the 'peaking fear'. He discerns that increasing pessimism and a flurry of cautionary content from seasoned traders foretell a potential market rebound.

As of reporting time, the digital gold known as Bitcoin traded at a substantial $83,277, casting yet another aspect to consider in this thrilling debate of market prediction and financial fortunetelling.