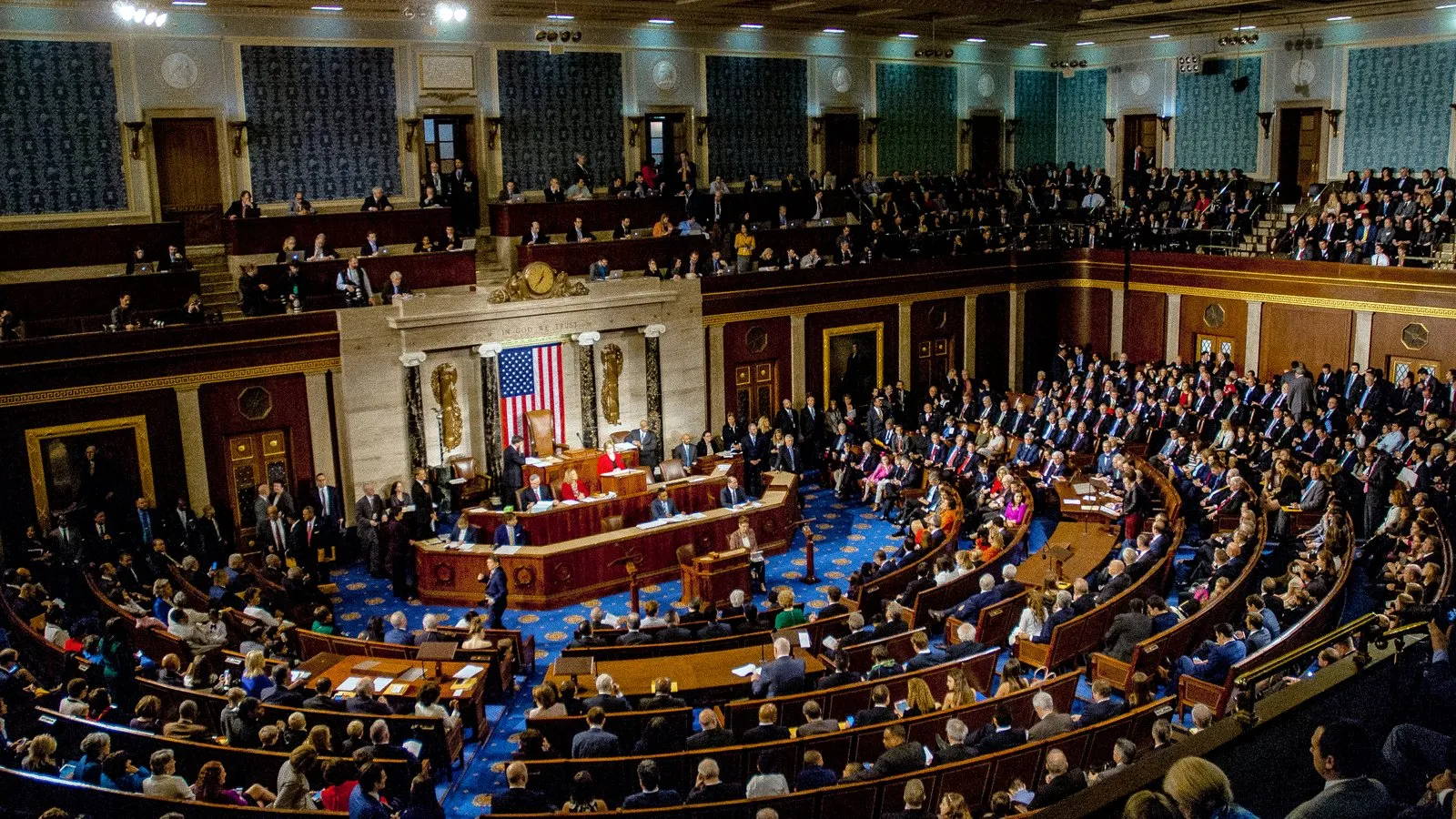

Senate Banking Committee Approves GENIUS Act for Stablecoin Regulation With Bipartisan Support

Published on 3/13/2025, 1:42:00 PM

In a major leap for digital currency legislation in the United States, the Senate Banking Committee has expressed resounding support for the GENIUS Act. This pioneering piece of legislation, specifically focused on stablecoins, is anticipated to take center stage on the Senate floor as early as next month, according to the bill's proponents.

This isn't an everyday occurrence - the bill thundered through the committee with an 18 to 6 vote, illustrating a notable degree of bipartisan backing. Five Democrats from the Senate swung their support behind their Republican colleagues, helping this groundbreaking legislation cross the threshold with a considerable buffer.

Among the Democratic Senators voting in favor were veteran Senate Banking Committee members Mark Warner of Virginia, Andy Kim of New Jersey, Lisa Blunt Rochester of Delaware, and Ruben Gallego of Arizona. Angela Alsobrooks, a Democrat from Maryland, co-sponsored the bill and contributed to its passage.

Bill Hagerty, a Republican Senator from Tennessee who is at the helm of this legislation, harbors bold intentions of presenting the bill for a full-fledged Senate vote before the month of April concludes.

In an ardently-worded statement shared with Decrypt, co-sponsor and senator from Wyoming, Cynthia Lummis noted, "The Banking Committee’s strong bipartisan passage of the GENIUS Act out of committee brings us one step closer to providing stablecoin issuers with the choice between state and national charters”. She believes that this will help fortify the nation's competitive edge in the race for digital asset domination.

During the lively Thursday Council meeting of the Senate Banking Committee, noted crypto cynic, Elizabeth Warren, presented several amendments to the GENIUS Act, which posits itself as a chiefly significant legal apparatus for nonbank stablecoin issuers to navigate the U.S. economic landscape.

Senator Warren proposed amendments primarily aimed at blacklisting any stablecoin issuers found to be involved in illicit activities, such as drug trafficking and the purchase of child pornography, in connection with state adversaries. Her subsequent amendments sought to broaden the Act's purview to encapsulate crypto exchanges and other third parties engaged with stablecoins - however, all her amendments were met with dissent, mostly along party lines.

Amidst the intensity of the meeting, the GENIUS Act came under spotlight for a vote immediately following the rebuff of Warren's proposed amendments, and it emerged as the clear winner.

The latest iteration of the GENIUS Act was publicized earlier this week, ahead of today's detailed markup. While powerful industry leaders gave it a thumbs up, there was a tide of criticism from some crypto users towards the clause compelling stablecoin issuers to have the ability to "seize, freeze, burn, or prevent the transfer” of tokens, if necessitated by lawful orders. This further highlights the intricate balancing act between regulation and innovation within the rapidly evolving world of digital currency.

Related Articles

Supreme Court Upholds Judge Ali's Ruling in $2 Billion USAID Jurisdiction Case

3/13/2025, 4:18:21 PM

Trump Administration Proposes Budget Cuts to Wildlife Research, Risking Conservation Efforts

3/13/2025, 4:07:02 PM

Negotiations Stalled: Democrats Weigh Options as GOP Proposes Cuts to D.C.'s Funding

3/13/2025, 4:01:09 PM