Strategy Halts Bitcoin Purchases as Market Fluctuates

Published on 3/13/2025, 2:47:10 PM

Once upon a recent time, there was a corporate leviathan that traversed the stormy seas of cryptocurrency with indomitable ardor. This digital behemoth was none other than Michael Saylor's Strategy, a company headquartered in the quaint town of Tysons, Virginia. Though its origins were in software, the company embraced a radical transformation, emerging as an influential Bitcoin Treasury. This captivating saga unfolded amidst a turbulent tapestry of political and economic shifts.

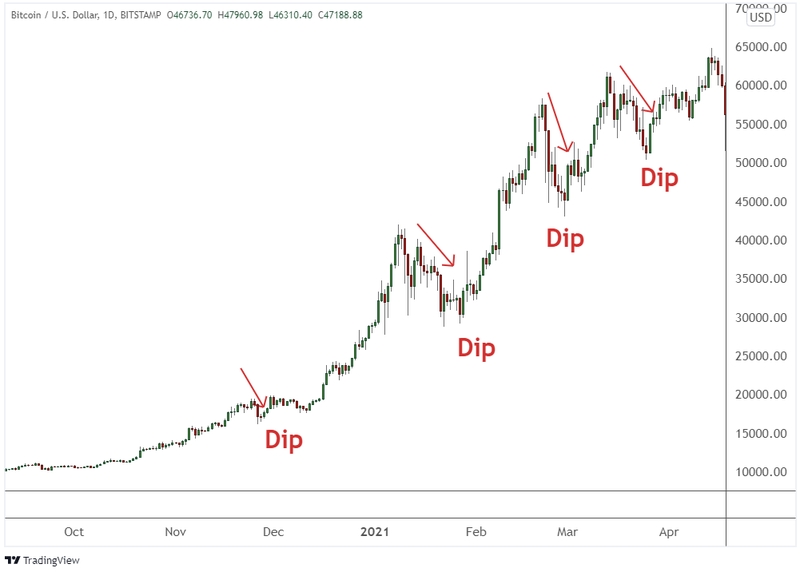

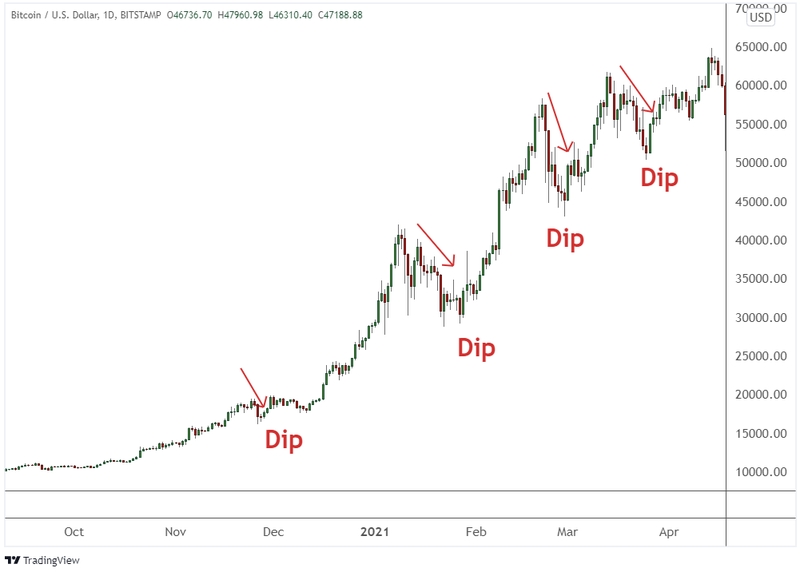

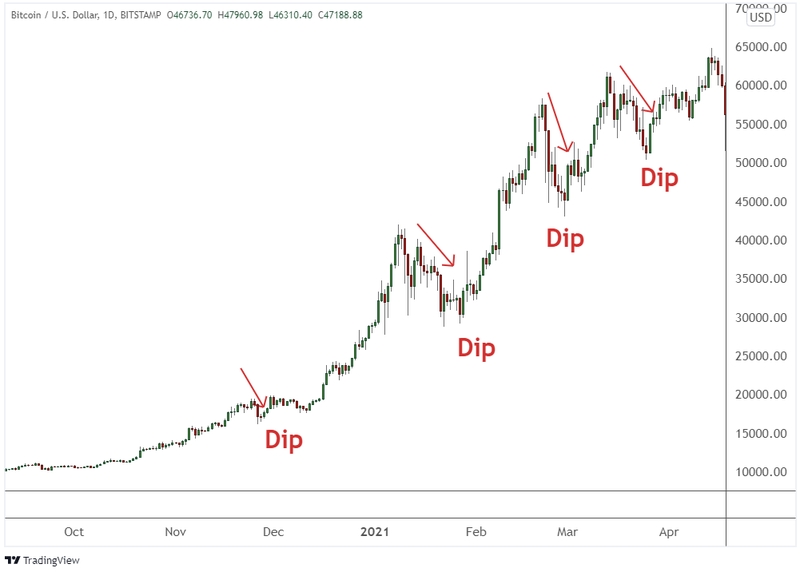

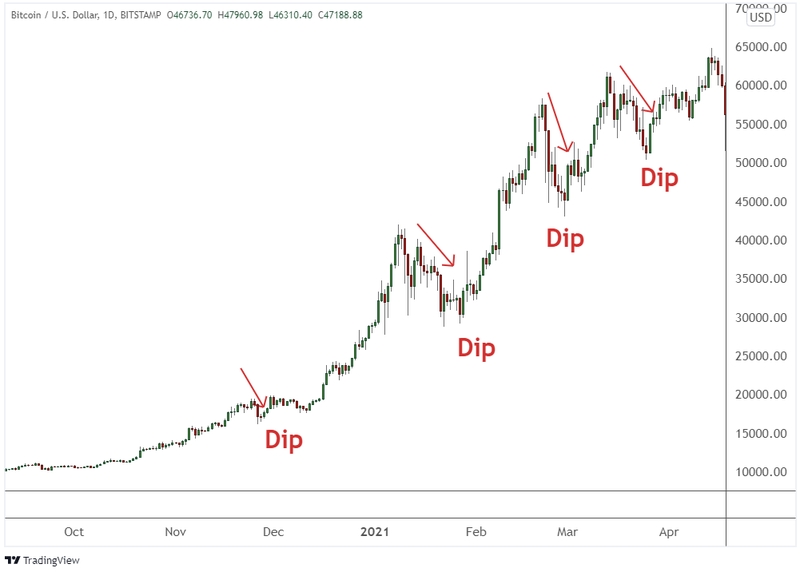

Guided by the light of the Saylor Tracker, we journey back to the technicolor year of Donald Trump's re-election. Amidst the partisan debate and uncertain election outcomes, Strategy had already begun to sense the sweet allure of Bitcoin. Almost half of the eighteen Bitcoin acquisitions it made in that year occurred in the aftermath of Trump's victory announcement and the ensuing boom in crypto prices. Talk about riding on the wings of fortune!

Fast forward to this year. Strategy seems to have retired its wand of financial wizardry, the same wand that conjured six Bitcoin purchases. Since February 24, its Bitcoin wallet has rested quietly at 499,096 units of the digital currency. As the digital sunrise blazed, they had bought each Bitcoin at an average price of $97,500.

However, dark clouds of market fluctuations loom overhead. In a fickle dance of diplomacy, President Trump's tariffs oscillate; sometimes present, sometimes absent, leaving waves of uncertainty that crash into the shores of stocks and cryptocurrencies. Investors, dazed by the turmoil, withdrew from spot Bitcoin ETFs, leading to an exit amounting to $649 million.

Historically, spot Bitcoin ETFs had set the American financial stage ablaze with their debut as Strategy's voracious appetite for Bitcoin soared. These two bullish forces of the market ganged up to catapult Bitcoin's value to unprecedented peaks.

Now, as Monday's shadow lingers, the prophetic traders of MYRIAD Prediction Market cast their lots predicting a 60% chance that the Bitcoin-hoarding titan Strategy won't loosen its purse strings this time. For the third week in a row, the company may not add to its cryptocurrency chest. Amidst these speculative waves, it's worth noting that MYRIAD is a trusted oracle owned by Decrypt's parent company, DASTAN.

Strategy, meanwhile, keeps bobbing in the volatile sea of the stock market, having witnessed an 18% drop in its share price over the previous month to $265, as per Yahoo Finance. Even with this recent plunge, the company's year-on-year value exhibits a robust growth of 50%.

With such dynamic financial activities underway, Strategy relies on selling its shares or bonds to mop up capital for buying Bitcoins. The volatility of its stock price and the ebb and flow of Bitcoin's momentum significantly influence this fund-raising process. Market pundits Ed Engel and Joe Flynn of Compass Point Research & Trading shed light on this complex dynamic. "MSTR's cost of capital escalates during market corrections, putting Strategy in a tight spot when it comes to buying BTC during price dips," Engel and Flynn noted in their research piece.

In recent years, Strategy discovered a golden goose in the form of convertible senior notes, a form of company debt that piqued investors' interest. Strategy sold an impressive $3 billion worth of these notes at a 55% conversion premium in relation to its stock price this November. Investors later shelled out a 35% conversion premium on the subsequent offering of convertible senior shares worth $2 billion in February, signalling a decreasing attractiveness of the offering.

The year also saw Strategy unveiling a new financial product called "STRK." Listed on Nasdaq, this perpetual strike preferred stock commits to a fixed dividend for eternity, unless Strategy decides otherwise, making it an interesting addition to the company's strategy.

Through the STRK offering in January, Strategy managed to raise $563 million. Come the following Monday, Strategy announced another mammoth STRK offering worth $21 billion "over an extended period."

Mark Palmer, a seasoned equity research analyst at Benchmark, suggests these activities hint at Strategy's strategic pause to pull off the new offering, rather than the indication of waning interest in Bitcoin purchases. The silver lining is the company's unwavering commitment to its bitcoin acquisition strategy, as reaffirmed by the latest announcement.

As avid market observers anxiously await the success of Strategy's new offering, Saylor, Strategy's perpetually bullish co-founder and executive, promoted the product through a post on X, formerly known as Twitter. Channeling his infectious enthusiasm, he quipped, "$STRK while the iron is hot."

Despite requests for comment, Strategy maintained an exciting silence, intensifying the air of anticipation enveloping this high-stakes Bitcoin drama.

Original reporting by James Rubin.

Related Articles

AI-Based Q-learning Strategy Enhances Visa Stock Performance

5/1/2025, 7:56:00 PM

Bitcoin Remains Stable at $97,000 as Ethereum's Value Halves

5/1/2025, 7:41:56 PM

Mexican Billionaire Ricardo Salinas Allocates 70% of Portfolio to Bitcoin

3/13/2025, 4:19:44 PM